行为经济学

行为经济学研究心理、认知、情感、文化和社会因素如何影响个人和机构的决策,以及这些决策与经典经济理论暗示下产生的决策有怎样的差别。

行为经济学主要研究经济行为主体的理性边界。行为模型通常会整合心理学、神经科学和微观经济学理论的观点[1][2]。行为经济学研究包括市场决策是如何做出的,以及驱动公共选择的机制。行为经济学中三个流行的主题是:

- 判断和决策的启发式:人类95% 的决策都是通过思维捷径或依据经验法则做出的。

- 框架效应: 由轶事奇闻和刻板印象构成的心理过滤器是人们理解和应对事件的依仗。

- 市场异象:包括价格机制和理性。

2002年,心理学家丹尼尔·卡尼曼 Daniel Kahneman被授予诺贝尔经济学奖,“因为他将心理学研究的成果整合到经济科学中,特别是关于不确定条件下人类的判断和决策[3]。”2013年,经济学家罗伯特·希勒 Robert J. Shiller因“对资产价格的实证分析”(属于金融学领域)而获得诺贝尔经济学奖[4]。2017年经济学家理查德·泰勒 Richard Thaler因为他“对行为经济学的贡献,以及他在不符合经济学原理的人类可预测性非理性行为方面的开创性工作”而被授予诺贝尔经济学奖[5][6]。

历史

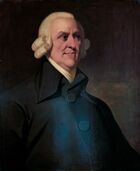

在古典经济学时期,微观经济学与心理学有着密切的联系。例如,Adam Smith的《道德情操论》提出了个人行为的心理学解释,包括一些对公平和正义的想法[7]。杰里米·边沁 Jeremy Bentham写了大量文章来讨论效用的心理学基础。然后,在新古典主义经济学 neo-classical economics的发展过程中,通过对经济行为主体性质的假设来推断行为,经济学家试图将该学科重塑为一门自然科学,即通过对经济行为主体性质的假设来推断主体行为。他们提出了经济人的概念——经济人的行为基本上是理性的。

新古典主义经济学家的确纳入了心理学的解释:Francis Edgeworth、Vilfredo Pareto和Irving Fisher就是如此。经济心理学在20世纪Gabriel Tarde[8],乔治·卡托纳 George Katona[9]和Laszlo Garai[10]的著作中出现。期望效用模型和折扣效用模型开始被接受,在存在不确定性和跨期消费的情况下生成有关决策的假设。然而一些人们观察到的、频繁重复的异常情况最终挑战了这些假说。研究者为此采取了进一步的步骤。例如,Maurice Allais设定了阿莱悖论 Allais paradox。Allais在1953年第一次提出这个决策问题,并用以反对期望效用假说。

在20世纪60年代,认知心理学 cognitive psychology开始给予大脑这一信息处理设备(与行为主义模型相对)更多的关注。这一领域的心理学家,如Ward Edwards,[11]、Amos Tversky和Daniel Kahneman开始将在一定风险性和不确定性下做决策的认知模型与理性行为的经济模型进行比较。数学心理学反映了长期以来研究者对偏好传递性和效用度量的兴趣。

有限理性

有限理性 Bounded rationality是指,当个体做出决策时,他们的理性受限于决策问题的可操作性、自身认知的局限性和时间。这种观点认为,决策者像满意者一样寻求一个令自己满意的解决方案,而不是寻求最佳的解决方案。Herbert A. Simon提出以有限理性为基础替代传统的决策数学模型,补充了“理性即优化”(即决策是一个完全理性的,基于已有信息获取最佳选择的过程)的观点[12]。Simon用一把剪刀做类比。剪刀的一个刀片代表人类认知的局限性,另一个刀片代表”环境结构” ,以此来说明人类思维是如何利用已知的环境结构规律来弥补资源有限这一问题的[12]。

有限理性意味着,走捷径的策略可能导致人们做出次优决策。行为经济学家从事主体决策捷径的绘制工作,以帮助人们提高决策的有效性。关于这个观点的一种论述来自卡斯 · 桑斯坦Cass Sunstein和Richard Thaler的《“助推” Nudge》一书[13][14]。Sunstein和Thaler建议,选项结构 choice architectures应该根据人类的有限理性进行修改。Sunstein和Thaler提出的一个被广泛引用的建议是,为了增加人们选择健康食品而不是不健康食品的可能性,应该把健康食品放在人们的视线范围内。一些对《助推》持批评态度的人则指出,修改选项结构将导致人们成为更糟糕的决策者[15][16]。

前景理论

1979年,Kahneman和Tversky发表了《前景理论: 风险下的决策分析 Prospect Theory: An Analysis of Decision Under Risk》一文,该文利用认知心理学解读了新古典主义经济决策理论中的多种分歧。前景理论 Prospect theory分为两个阶段:编辑阶段和评估阶段。

在编辑阶段,人们使用各种启发式简化风险情况。在评估阶段,人们利用各种心理学原则对风险选项进行评估,这些原则中包括:

- 参考依赖 Reference dependence:评估结果时,决策者会确定一个“参考水平”,然后将结果与参考点进行比较。如果结果大于参考点则归类为”收益” ,如果小于参考点则为”损失”。

- 损失厌恶 Loss aversion:相比追求等价的收益,人们更倾向于规避损失。在1992年的论文中,Kahneman和Tversky发现损失厌恶系数的中位数大约是2.25。也就是说,损失造成的伤害是同等收益的2.25倍[17]。

- 非线性概率加权:决策者重小概率而轻大概率——这就产生了反 S 型的“概率加权函数”。

- 对收益和损失的敏感度递减:当收益和损失的大小相对于参考点的绝对值增加时,对决策者的效用或满意度产生影响的边际效用就会减弱。

前景理论能够解释已有的两个主要决策理论,即期望效用理论 expected utility theory和等级依赖效用理论 rank dependent utility theory。此外,前景理论也能被用来解释现有决策理论难以解释的现象。这些现象包括后弯的劳动力供给曲线、不对称的价格弹性、逃税以及股票价格和消费的共同波动。

1992年,在《风险与不确定性 Risk and Uncertainty》期刊上,Kahneman和Tversky对前景理论进行了修正,并将修正结果称之为累积前景理论 cumulative prospect theory[17]。新理论消除了前景理论中的编辑阶段,只注重评估阶段。它的主要特点是允许以累积的方式对概率进行非线性的加权,而这个想法最初出现于约翰·奎金 John Quiggin的等级依赖效用理论中。

一些心理特征,如过度自信、投射偏差和有限的注意力等现已经成为这个理论的一部分。其他进展包括:在芝加哥大学举行的一次会议,《经济学季刊 Quarterly Journal of Economics》上的一期行为经济学特刊《纪念阿莫斯·特沃斯基 In Memory of Amos Tversky》,以及Kahneman“将心理学研究的见解整合到经济科学中,特别是在不确定条件下的人类判断和决策尤为重要”而获得的2002年诺贝尔奖[18]。

跨期选择

行为经济学已经被应用到跨期选择中。跨期选择是指在某个时间点做出决策,在另一个时间点获得该决策所产生的效果。跨期选择行为在很大程度上是不一致的,George Ainslie的双曲折扣就是一个很好的例子——David Laibson、Ted O'Donoghue和Matthew Rabin则进一步发展了这个想法。双曲折扣描述了一种倾向,即与遥远的未来相比,人们更倾向于对在较近的未来会产生的结果打折扣。这种折扣模式在动态上是不一致的(或者说是在时间上不一致的),因此它与理性选择的基本模型不一致——因为时间 t 和 t + 1之间的折扣率比在时间 t-1 和t 时低(当t是较近的未来时),但是也会更高(在时间 t 为现在, 而 t + 1 为较近的未来时)。

这种模式也可以通过次加法折扣模型来解释,这种模型区分了折扣的延迟和折扣的时间间隔:无论折扣何时发生,人们在较短的折扣时间间隔内都缺乏耐心。

研究的其他领域

行为经济学的其他分支丰富了效用函数模型,但并不蕴含偏好的不一致性。恩斯特·费尔 Ernst Fehr、阿明·福柯 Armin Falk和 拉宾 Rabin 研究了公平、不公平厌恶 inequity aversion和互惠利他reciprocal altruism,削弱了新古典主义中完美自私的假设。这项工作特别适用于工资确定这一问题。Gneezy 、 Rustichini 关于“内在动机”和 Akerlof 、 Kranton 关于“认同”的工作都假定,主体除了从条件期望效用 conditional expected utility中获得效用以外,也会从个人和社会规范中获得效用。根据Aggarwal的观点,除了行为偏离合理均衡 rational equilibrium,市场还可能受到响应滞后 lagged responses,搜索成本 search costs,极端情况 externalities of the commons以及其他冲突的影响,这使研究者难以从市场行为中区分(个人的)行为效应[19]。

“条件期望效用”是一种个人自认为拥有掌控权的错觉,并根据他们自己的行为去计算外部事件发生的概率,进而自己得出效用结果,即使他们没有能力影响外部事件[20][21]。

行为经济学随着丹·埃利里Dan Ariely的《怪诞行为学 Predictably Irrational》等书籍的成功而在普通大众中流行起来。该学科的从业者研究了宽带制图等准公共政策专题 quasi-public policy topics[22][23]。

行为经济学的应用包括,在人工智能和机器学习中对消费者决策过程建模。硅谷公司奇点Singularities在使用阿尔肖伦 Alchourrón、加登弗斯Gärdenfors和梅金森 Makinson 提出的AGM假设,即信念概念的形式化和理性实体的改变,在符号逻辑中创建一个“使用最新的数据科学和大数据算法的机器学习和演绎引擎,以生成捕捉客户的行为和想法的内容和条件规则(即一些反事实推理) 。” [24]

行为经济学的应用也存在于其他学科,例如供应链管理[25]。

自然实验

从生物学的角度来看,不管是股市崩溃的危机期还是股价超过历史高点的泡沫增长期,人类行为的本质是一致的。在这些时期,大多数市场参与者看到了对自己有用的新东西,这不可避免地引发了压力反应,内分泌系统和心理动机也随之发生变化。而最终结果就是人的行为发生定量和定性的变化。这是一个典型的运用行为经济学来观察、对比人类行为是如何影响经济和金融的例子。

行为经济学不仅在类似证券交易所的环境中会发挥作用。我们可以在犯罪隐瞒行为中发现自私推理、“成人行为”以及不同类型的法律缺陷和疏忽。需要明确的是不同实验模型和方法具有利用间接后果的认识(或缺乏)的的能力——至少是潜力。行为经济学的潜在用途是广泛的,但需要审查其可靠性。低估新异作为一种压力源的作用是目前市场研究方法的主要缺点。研究方法有必要解释在日常低应激条件下和应对应激源的时候,人类行为中具有的由生物学所决定的双相性 diphasisms[26] Angus Deaton对实验方法(如随机对照试验)的局限性及其在经济学中的应用进行了著名的分析。.[27]。

批评

行为经济学的批评通常强调经济行为主体的理性[28]。玛亚莱Maaialeh (2019)提供了一个基本的批评,他认为没有行为研究可以建立一个经济学理论。这些例子包括,行为经济学的支柱:从新古典主义的反面分别挑战效用最大化和期望效用理论的满意行为和前景理论。作者向读者展示,行为研究结果很难被推广,而且它们不能否定理性行为有关的典型主流公理[29]。

其他人则指出,前景理论等认知理论是决策模型,而不是推广化的经济行为。它们只适用于向实验参与者或调查对象提出的一次性的决策问题。其他人认为决策模型,如已被广泛接受的禀赋效应理论 endowment effect theory,行为经济学家,可能被错误地建立为糟糕的实验设计实践的后果,没有充分控制受试者的错误概念[30][31][32] 。

行为经济学的批评者通常强调经济主体的理性。他们认为,实验观察到的行为在市场环境中的应用有限,这是因为学习机会和竞争至少能确保他们接近理性。

另一些人指出,认知理论,如前景理论,是决策模型而不是广义的经济行为。它们只适用于向实验参与者或调查对象提出的那种一次性决策问题。

一个值得关注的问题是,尽管有大量的修饰与措辞,但仍然没有一个统率性的行为理论得到支持,也就是说,行为经济学家还没有提出统一的理论。

大卫·加尔 David Gal认为,这些争论中的许多问题源于行为经济学过分执着于分析行为是如何偏离标准经济模型,而不是理解人们为什么会这样做。理解特定行为发生的原因对于归纳性知识的诞生很必要——这也是科学的目标。他还将行为经济学称为“市场营销的胜利” ,并特别提到了损失厌恶的例子[33]。

传统经济学家对行为经济学广泛使用的实验和调查技术持怀疑态度。经济学家通常会强调,在决定经济价值时,与显示性偏好相比,他们更偏向于展示(来自调查的)陈诉偏好。实验和调查具有系统偏差、策略行为和缺乏激励相容的风险。一些研究人员指出,行为经济学实验的参与者代表性不够,因此具有广泛适用性的结论不可能在此类实验的基础上得出。为了描述这些研究的参与者——这些受过教育且有富裕民主的工业化社会背景的西方实验参与者,被人们描述为 :WEIRD(各个单词首字母的集合)[34]。

回应

Matthew Rabin反驳了这些批评。他认为一致的结果通常是在多种情况和复杂地理环境下获得的,并且可以由此产生很好的理论洞察力。然而,行为经济学家则将对这些批评的回应重点放在田野研究而不是实验室实验上。一些经济学家认为实验经济学和行为经济学之间存在根本的分歧,但一些杰出的行为和实验经济学家倾向于在一些共同问题上作出交叉性的回答。例如,行为经济学家正在研究神经经济学——它是完全实验性的且尚未在该领域得到验证。

行为经济学的认识论、本体论和方法论饱受争议,尤其是在经济学史学家和经济方法论学家这里[35]。

一些研究人员表示[26],在研究决策基础的机制(尤其是财务决策)时,有必要认识到大多数决策都是在压力状态下做出的[36],因为“压力是身体在面对任务时的非特异性反应。” [37]

应用问题

“助推”理论

“助推 Nudge”是行为科学、政治理论和经济学中的一个概念,该理论提出正强化 positive reinforcement和间接暗示 indirect suggestions可以影响群体或个体行为与决策。“助推”与其他实现依从的方式,比如教育、立法或执法,形成了鲜明对比。这个概念已经影响了英国和美国的政治家。在世界各地,国家层面(英国、德国、日本和其他国家)和国际层面(经济合作与发展组织OECD、世界银行、联合国),都存在一些“助推”单位。

詹姆斯·沃尔夫 James Wilk 早在1995年以前就在控制论中首次提出了这一术语和相关原则,布鲁内尔大学的学者 斯图尔特 D. J. Stewart 称之为“助推”的艺术(有时称为“微推 micronudges”[38])。它还受到了临床心理治疗方法论的影响,这些方法可以追溯到Gregory Bateson,包括Milton Erickson,Watzlawick,Weakland,Fisch,和Bill O'Hanlon的研究[39]。在这个变体中,”助推”是一个针对特定人群的微观目标设计,而不考虑预期干预的规模。

2008年,Richard Thaler和Cass Sunstein的书《“助推”:我们如何做出最佳选择 Nudge: Improving Decisions About Health, Wealth, and Happiness》让”助推”理论得到了重视。它还赢得了部分美国和英国的政界人士、私营部门以及公共卫生领域人员的追随[40]。两位作者把非强制的影响施加过程称为软家长作风 libertarian paternalism,称影响者为选择建筑师 choice architects[41] 。Thaler和Sunstein将他们的理论定义为:

正如我们将要提到的那样,“助推”是指选项结构 choice architecture中的任意一个,即在不禁止任何选择,也不颠覆人们经济动机的条件下以可预测的方式改变人的行为。而只有能被轻易做到的干预才能被算作一次“助推”。“助推”不是命令。把水果放在眼睛所在的高度算是“助推”,禁止垃圾食品就不是。

在这种形式下,借鉴行为经济学,“助推”能够更广泛地应用于行为影响。

人们经常引用的一个”助推”例子是,在阿姆斯特丹史基浦机场的男厕所小便池里画了家蝇的图象。这么做的目的是“优化目标” [13]。

“助推”技巧的目的是利用判断启发式给我们提供好处。换句话说,”助推”改变了环境,所以当使用了启发式,也就是系统1来做决策的时候,往往就会出现最积极的或最想要的结果[42]。一个例子就是,改变一些产品在商店里的位置——将健康食物放在收银机旁边,把垃圾食品搬到别部分[43]。

2008年,美国任命帮助完善该理论的Sunstein为信息和管理事务办公室Office of Information and Regulatory Affairs的管理员[41][44][45]

。

“助推”理论的主要应用包括2010年英国行为洞察小组British Behavioural Insights Team的成立。它从属于戴维·哈珀恩 David Halpern领导的英国内阁办公室 British Cabinet Office,常被称为“助推”小组 [46]。

英国首相戴维·卡梅伦 David Cameron和美国前总统·奥巴马 Barack Obama都试图在任期内运用”助推”理论来实现国内政策目标[47]。

在澳大利亚,新南威尔士州政府建立了一个行为洞察实践社区Behavioural Insights community of practice[48]。

“助推”理论也被应用于企业管理和企业文化,包括健康、安全、环境(health, safety and environment, HSE)、人力资源等领域。应用”助推”在HSE中的主要目标之一是实现“零事故文化 zero accident culture” [49]。

硅谷的各个企业巨头是”助推”理论应用方面的先锋。这些公司正在用各种方式的”助推”来提高员工的生产力和幸福感。最近,越来越多的公司开始研究如何利用“助推”管理来提高白领工人的生产率[50]。

目前世界上许多国家都在运用行为洞察力和“助推”力[51]。

批评

“助推”也受到了批评。来自公共卫生基金会“国王基金会 The King's Fund”的Tammy Boyce说:“我们避免短期的、出于政治动机的行动,比如‘“助推”人们的想法——这种想法没有任何有力的证据支撑,也无助于人们做出长期的改变。[52]”

Sunstein在他的《影响力的道德 The Ethics of Influence》[53]一书中对批评做出了详尽的回应,表示支持“助推”并反对那些认为“助推”会削弱自主权、威胁尊严、侵犯自由或减少福利的指控。伦理学家们对此展开了激烈的辩论。这些指控是由博芬申Bovens,古德温 Goodwin等辩论参与者提出的。例如,Wilkinson指责”助推”对会操纵个人行为,而杨 Yeung等人则质疑其科学可信度[54]

。

Hausman和Welch[55]等人曾提出,在分配公平的基础上,“助推”是否应该被允许;Lepenies和Malecka[56]曾质疑”助推”是否符合法律规范。类似地,法律学者也讨论了“助推”和法律所扮演的角色[57][58]

。

Bob Sugden等行为经济学家指出,”助推”的基准仍然是经济人——尽管该理论的支持者认为恰恰相反。[59]

有人说,”助推”也是社会工程学里对心理操纵的委婉说法[60][61]

。

在强调积极参与“助推”的匈牙利社会心理学家(弗伦茨·梅雷 Ferenc Merei[62] 和拉斯洛·加莱 Laszlo Garai[10]))的著作中,对“助推”理论的预期和含蓄批评同时存在。

行为金融学

行为金融学 behavioral finance的核心问题是解释为什么市场参与者会犯与理性市场参与者假设相反的系统性非理性错误。这些错误会影响价格和收益,造成市场失效 market inefficiencies。行为金融学也研究其他参与者如何利用这些错误和市场失效为自己牟利,也就是所谓的“套利”。

行为金融学关注低效率,例如对信息反应迟钝或过激——它们引导着市场趋势,触发极端情况下的泡沫和崩溃。这被归因于投资者注意有限、过度自信、过于乐观、模仿(集群本能)和噪音交易。技术分析家认为行为金融学是行为经济学的“学术表亲” ,是技术分析的理论基础。

其他关键的观察还包括获取和保留资源之间的不对称决策,即所谓的“林中之鸟(没把握的事)”悖论,以及损失厌恶——即不愿意放弃有价值的财产。损失厌恶可以表现为投资者在可能产生少量损失的条件下不愿出售股票或其他股权。这可能也有助于解释为什么在需求低迷时期,会出现房价很少或者以极慢的速度下降到市场清算水平的现象。

通过使用前景理论的一个版本,Benartzi和Thaler声称已经解决了股权溢价之谜——一个传统金融模型迄今无法解决的问题。实验金融学在研究过程中会运用实验的方法,例如通过某种模拟软件人为创造一个市场来研究人们在金融市场中的决策过程和行为。

量化行为金融学

量化行为金融学 Quantitative behavioral finance使用数学和统计方法来研究行为偏差。在市场研究中,一项调查显示没有证据表明逐步升级的偏见会影响市场决策[63]。主要贡献者包括冈兹·卡基纳尔普 Gunduz Caginalp (2001-2004年《行为金融学期刊 Journal of Behavioral Finance》的编辑) ,合作者包括2002年诺贝尔奖获得者弗农·史密斯 Vernon Smith,戴维·波特 David Porter,唐·巴列诺维奇 Don Balenovich[64],弗拉基米尔·黎利耶夫 Vladimira Ilieva ,艾哈迈德·杜兰 Ahmet Duran[65]以及雷·斯特姆 Ray Sturm[66]。

金融模型

一些用于货币管理和资产评估的金融模型与行为金融学参数相结合。例如:

- Thaler制造过一个通过信息回馈来创造价格市场趋势的价格反应模型。该模型具有三个阶段(反应不足、调整和反应过度)。

反应过度的一个特点是,宣布好消息后获得的平均收益低于宣布坏消息后获得的。换句话说,如果市场对新闻反应过强或过长就会出现反应过度现象,所以需要向反方向作出调整。因此,在一个时期超常表现的资产在下一个时期可能表现不佳。这也适用于解读消费者不理性的购买习惯[67]

。

- 股票估价或股票图像系数

批评

像尤金·珐玛 Eugene Fama 一样,许多批评家通常支持市场有效性假说 efficient-market hypothesis。他们认为,与其说是一个真正的金融学分支,行为金融学更像是一个异常现象的集合——这些异常现象要么很快被排挤出市场,要么可以通过市场微观结构理论来解释。然而,个人认知偏差不同于社会偏差;前者可以被市场平均化,而后者可以创造正反馈循环从而使市场越来越偏离”公平价格”这一均衡状态。同样,对于违反市场有效性的异常现象,投资者必须有能力进行反向交易并获得异常利润。但事实上许多人难以做到[68] 。

该批评的一个具体例子出现在对股票溢价之谜的一些解释中。有人认为,股票溢价之谜的原因是壁垒(既是实际上的也是心理上的),并声称随着电子资源使股票市场向更多的交易者开放,股票和债券之间的回报应该相等[69]。作为回应,其他人认为,大多数个人投资基金是通过养老基金管理的,这最小化了这些假定壁垒的影响[citation needed]。此外,考虑到回报率差异,专业投资者和基金经理持有的债券似乎超出了人们的预期。

行为博弈论

行为博弈论 Behavioral game theory由科林·卡梅勒 Colin Camerer发明,运用博弈论[70]、实验经济学和实验心理学的方法分析交互式战略决策和行为。实验包括检验典型的经济理论简化的偏差,如独立公理 independence axiom[71]和忽视利他主义[72]、公平公正[73],和框架效应 framing effects[74]。积极的一面是,这种方法已经应用于交互式学习[75]和社会偏好的研究[76][77][78]。这是一门在近三十年的时间里发展起来的研究课题[79][80][81][82][83][84][85] 。

动物的经济推理

一些比较心理学家试图证明除了人,其他的动物也能够进行准经济推理 quasi-economic reasoning。早期尝试集中在大鼠和鸽子的行为研究上。这些研究运用了比较心理学的原则,其主要目标是在非人类动物实验体身上发现类人行为。它在研究方法上也与费斯特 Ferster和斯金纳 Skinner的工作相似[86]。撇开这些不谈,非人类经济学 non-human economics的早期研究者所使用的术语偏离了行为主义的准则。尽管这些研究主要通过设置操作条件箱 operant conditioning chamber——用食物奖励啄食或按棒的行为——来获得,但研究人员并未从强化与刺激-反应关系的角度来描述这些行为,而是从工作、需求、预算和劳动力的角度进行阐释。最近的研究采用了稍微不同的方法,从人类进化的角度,将人类的经济行为与一种灵长类动物卷尾猴进行了比较[87] 。

动物研究

许多关于非人类经济推理的早期研究都是在操作条件箱中的大鼠和鸽子身上进行的。这些研究记录了在一定奖励条件下的(鸽子)啄食率和(大鼠)压棒率。例如,早期的研究人员声称,反应模式(啄食或压棒速率)是劳动力供应的一个恰当类比[88]。这个领域的研究人员主张用动物的经济行为来理解基本的人类经济行为[89]。巴塔利奥 Battalio,格林 Green和凯格尔 Kagel[88]在他们的一篇论文中写道:

限于篇幅,研究者无法详细讨论为什么经济学家应该严肃对待使用非人类研究对象所进行的经济学理论研究(对动物的经济行为的研究)……因为这样的研究提供了一个用于识别、测试和深入理解经济行为一般规律的实验室。这个实验室的运行基于物种之间不同的行为和结构。经济行为原则如果不适用于非人类(当然也有一些变化),那么经济行为将是独一无二的。

劳动供给

典型的鸽子劳动供给研究的实验环境是这样的:鸽子一开始就被剥夺食物。随着饥饿感的增强,它们变得渴望食物。然后鸽子被放在操作条件箱中,在定向和探索箱子环境的过程中,它们发现通过啄食房间一侧的小圆盘,可以获得被送来的食物。实际上,因为与食物有关,啄食行为得到了强化。不久之后,鸽子会定期啄食圆盘(或刺激物)。

在这种情况下,我们可以说鸽子为食物而“工作”:重复进行啄这一动作。因此,食物被认为是货币。货币的价值可以通过几种方式进行调整,包括提供食物的数量、速度和类型(有些食物比其他食物更受欢迎)。

当奖励减少时,饥饿的鸽子停止或减少工作,这和人类的经济行为相似。研究人员认为,这实际上与人类的劳动供给行为相似。也就是说,像人类一样(即使在需要食物的时候,面对既定工资也只会完成固定的工作量),当回报(价值)减少时,鸽子会表现出啄食行为(工作)的减少[88]。

需求

在人类经济学中,典型的需求曲线具有负斜率。这意味着,随着某种商品价格的上涨,消费者愿意并且能够购买的数量会减少。研究人员在研究非人类动物(如大鼠)的需求曲线时,也发现了同样的情况。

研究人员用一种不同于研究鸽子劳动力供应关系的方式来研究大鼠的需求。具体就是,在一个以大鼠为实验对象的操作条件箱中,我们要求它们下压一个小杆而不是啄一个小圆盘以获得奖励。奖励可以是食物(奖励食丸)、水,或者像樱桃可乐这样的饮料。在以前的鸽子研究中,劳动的模拟行为是啄食,金钱的模拟物是奖励。大鼠的实验中工作的模拟行为则是压杆。在这种情况下,研究人员声称,改变能够获得商品的压杆次数标准类似于在人类经济学中改变商品的价格[90]

。

实际上,对动物需求的研究结果表明,随着压杆要求(成本)的增加,动物压杆等于或大于压杆要求(回报)的次数在减少。

进化心理学

进化心理学 evolutionary psychology认为,我们可以这么解释理性选择中的许多局限性——在最大化生物适应性的祖传环境中的理性选择在当前环境中却不一定是。因此,当因资源减少而不得不生活在贫困线上,甚至可能面对死亡时,理性的做法是重视避免损失而不是获得收益。这也可以解释不同群体之间的行为差异,例如男性相对女性会更轻视风险规避,因为男性比女性有更大的繁殖成功率。虽然失败的冒险行为可能会同时限制两性的繁殖成功率,但对男性而言,一旦冒险行为成功,其更有可能提高繁殖成功率[91]。

人工智能

越来越多的决策开始由人工智能辅助下的人类做出,或者直接由人工智能做出。齐立兹·马尔瓦拉 Tshilidzi Marwala和埃文·赫维兹 Evan Hurwitz在他们的书中[92]研究了行为经济学在这种情况下的效用,并得出结论,称这些智能机器减少了有限理性决策的影响。特别是,他们观察到这些智能机器降低了市场的信息不对称水平,促进决策改善,从而使市场更加理性。

人工智能在市场上的应用(如在线交易和决策)已经改变了主流经济理论[92]。受人工智能影响的理论还包括理性选择 rational choice、理性预期 rational expectations、博弈论 game theory、刘易斯转折点 Lewis turning point、投资组合优化 portfolio optimization和反事实思维 counterfactual thinking。

相关领域

实验经济学

实验经济学通过运用统计学、计量经济学 econometric和计算经济学 computational[93]等实验方法来研究经济问题。实验中收集的数据被用于估计效果量,检验经济理论的有效性,以及阐明市场机制。经济实验通常使用现金来激励受试者,以模拟现实世界的激励。这些实验被用来解读市场和其他交易系统是如何以及为何这样运作的。实验经济学还被扩展到机构组织和法律(实验法律和经济学)的研究中去[94]。

这门学科的一个基本方面是实验设计。无论是个人行为还是群体行为,实验既可以在真实生活场景中(田野)进行,也可以在实验室环境中进行。

除了正式的标准实验,这里还有一些变体,包括自然实验和准自然实验[95]。

神经经济学

神经经济学 Neuroeconomics是一个跨学科的领域,旨在探索研究人类决策机制以及人类处理多重选项的能力。该学科遵循一个行动方针。它研究经济行为如何影响我们对大脑的理解,以及神经科学的发现如何约束和指导经济学模型的建构与发展[96] 。

它综合运用了神经科学、实验和行为经济学以及认知和社会心理学的研究方法[97]。随着对决策行为的研究变得越来越与计算机相关,它也吸收了来自理论生物学、计算机科学和数学领域的新方法。神经经济学使用组合工具来研究决策,以避免出现因使用单一方法而产生的弊端。在主流经济学中,期望效用和理性主体这一概念仍被使用。不过这些模型无法充分解释某些经济行为,比如启发式和框架效应[98]

。

行为经济学在解读经济决策时,通过综合考虑社会、认知和情感因素来解释这些异常现象。神经经济学通过运用神经科学研究的方法为理解经济行为和神经机制之间的相互作用又增加了新的维度。通过使用来自不同领域的工具,一些学者声称神经经济学提供了一种更加综合的方式来帮助人理解决策机制[96]

。

参见

- 适应性市场假设 adaptive market hypothesis

- 行为主义 Behavioralism

- 行为运筹学 Behavioral operations research

- 确认偏差 Confirmation bias

- 文化经济学 Cultural economics

- 经济社会学 Economic sociology

- 情绪偏差 Emotional bias

- 模糊痕迹理论 Fuzzy-trace theory

- 后见之明偏差 Hindsight bias

- 市场情绪 Market sentiment

- 人类行为学 Praxeology

- 后悔理论 Regret theory

- 社会经济学 Socioeconomics

- 社会学 Socionomics (一种研究社会情绪和社会行为之间关系的学科,由Robert R. Prechter, Jr.创立。)

引入文献

- ↑ "Search of behavioural economics".

- ↑ Minton, Elizabeth A.; Kahle, Lynn R. (2013). [[[:模板:Google books]] Belief Systems, Religion, and Behavioral Economics: Marketing in Multicultural Environments]. Business Expert Press. ISBN 978-1-60649-704-3. 模板:Google books.

- ↑ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2002". Nobel Foundation. Retrieved 2008-10-14.

- ↑ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2013". Nobel Foundation. Retrieved 2016-07-01.

- ↑ Appelbaum, Binyamin (2017-10-09). "Nobel in Economics is Awarded to Richard Thaler". The New York Times. Retrieved 2017-11-04.

- ↑ Carrasco-Villanueva, Marco (2017-10-18). "Richard Thaler y el auge de la Economía Conductual". Lucidez (in español). Retrieved 2018-10-31.

- ↑ Ashraf, Nava; Camerer, Colin F.; Loewenstein, George (2005). "Adam Smith, Behavioral Economist" (PDF). Journal of Economic Perspectives. 19 (3): 131–45. doi:10.1257/089533005774357897. Archived from the original (PDF) on 2012-04-17. Retrieved 2011-12-20..

- ↑ Tarde, G. (1902). "Psychologie économique" (in French).

{{cite web}}: CS1 maint: unrecognized language (link) - ↑ Katona, George (2011). [[[:模板:Google books]] The Powerful Consumer: Psychological Studies of the American Economy]. Literary Licensing, LLC. ISBN 978-1-258-21844-7. 模板:Google books.

- ↑ 10.0 10.1 Garai, Laszlo (2017). "The Double-Storied Structure of Social Identity". Reconsidering Identity Economics. New York: Palgrave Macmillan.

- ↑ "Ward Edward Papers". Archival Collections. Archived from the original on 2008-04-16. Retrieved 2008-04-25.

- ↑ 12.0 12.1 Gigerenzer, Gerd; Selten, Reinhard (2002). Bounded Rationality: The Adaptive Toolbox. MIT Press.

- ↑ 13.0 13.1 Thaler, Richard H., Sunstein, Cass R. (April 8, 2008). Nudge: Improving Decisions about Health, Wealth, and Happiness. Yale University Press. ISBN 978-0-14-311526-7. OCLC 791403664.

- ↑ Thaler, Richard H., Sunstein, Cass R. and Balz, John P. (April 2, 2010). Choice Architecture. doi:10.2139/ssrn.1583509. SSRN 1583509.

- ↑ Wright, Joshua; Ginsberg, Douglas (February 16, 2012). "Free to Err?: Behavioral Law and Economics and its Implications for Liberty". Library of Law & Liberty.

- ↑ Sunstein, Cass (2009). [[[:模板:Google books]] Going to Extremes: How Like Minds Unite and Divide]. Oxford University Press. ISBN 9780199793143. 模板:Google books.

- ↑ 17.0 17.1 Tversky, Amos; Kahneman, Daniel (1992). "Advances in Prospect Theory: Cumulative Representation of Uncertaintly". Journal of Risk and Uncertainty. 5 (4): 297–323. doi:10.1007/BF00122574. ISSN 0895-5646.Abstract.

- ↑ "Nobel Laureates 2002". Nobelprize.org. Archived from the original on 10 April 2008. Retrieved 2008-04-25.

- ↑ Aggarwal, Raj (2014). "Animal Spirits in Financial Economics: A Review of Deviations from Economic Rationality". International Review of Financial Analysis. 32 (1): 179–87. doi:10.1016/j.irfa.2013.07.018.

- ↑ Grafstein R (1995). "Rationality as Conditional Expected Utility Maximization". Political Psychology. 16 (1): 63–80. doi:10.2307/3791450. JSTOR 3791450.

- ↑ Shafir E, Tversky A (1992). "Thinking through uncertainty: nonconsequential reasoning and choice". Cognitive Psychology. 24 (4): 449–74. doi:10.1016/0010-0285(92)90015-T. PMID 1473331.

- ↑ "US National Broadband Plan: good in theory". Telco 2.0. March 17, 2010. Retrieved 2010-09-23.

... Sara Wedeman's awful experience with this is instructive....

- ↑ Cook, Gordon; Wedeman, Sara (July 1, 2009). "Connectivity, the Five Freedoms, and Prosperity". Community Broadband Networks. Retrieved 2010-09-23.

- ↑ "Singluarities Our Company". Singular Me, LLC. 2017. Archived from the original on 2017-11-12. Retrieved 2017-07-12.

... machine learning and deduction engine that uses the latest data science and big data algorithms in order to generate the content and conditional rules (counterfactuals) that capture customer's behaviors and beliefs....

- ↑ Schorsch, Timm; Marcus Wallenburg, Carl; Wieland, Andreas (2017). "The human factor in SCM: Introducing a meta-theory of behavioral supply chain management". International Journal of Physical Distribution & Logistics Management. 47: 238–262. doi:10.1108/IJPDLM-10-2015-0268.

- ↑ 26.0 26.1 Sarapultsev, A.; Sarapultsev, P. (2014). "Novelty, Stress, and Biological Roots in Human Market Behavior". Behavioral Sciences. 4 (1): 53–69. doi:10.3390/bs4010053. PMC 4219248. PMID 25379268.

- ↑ Blattman, Christopher. "Why Angus Deaton Deserved the Nobel Prize in Economics". Foreign Policy. Retrieved 18 February 2020.

- ↑ Myagkov; Plott (1997). "Exchange Economies and Loss Exposure: Experiments Exploring Prospect Theory and Competitive Equilibria in Market Environments" (PDF).

{{cite journal}}: Cite journal requires|journal=(help) - ↑ Maialeh, Robin (2019). "Generalization of results and neoclassical rationality: unresolved controversies of behavioural economics methodology". Quality & Quantity. 53 (4): 1743–1761. doi:10.1007/s11135-019-00837-1.

- ↑ Klass, Greg; Zeiler, Kathryn (2013-01-01). "Against Endowment Theory: Experimental Economics and Legal Scholarship". UCLA Law Review. 61 (1): 2.

- ↑ Zeiler, Kathryn (2011-01-01). "The Willingness to Pay-Willingness to Accept Gap, the 'Endowment Effect,' Subject Misconceptions, and Experimental Procedures for Eliciting Valuations: Reply". American Economic Review. 101: 1012.

- ↑ Zeiler, Kathryn (2005-01-01). "The Willingness to Pay-Willingness to Accept Gap, the 'Endowment Effect,' Subject Misconceptions, and Experimental Procedures for Eliciting Valuations". American Economic Review. 95: 530.

- ↑ "Opinion | Why Is Behavioral Economics So Popular?" (in English). Retrieved 2018-11-16.

- ↑ Joseph Henrich, Steven J. Heine, Ara Norenzayan, The weirdest people in the world?, „Behavioral and brain sciences”, 2010.

- ↑ Kersting, Felix; Obst, Daniel (10 April 2016). "Behavioral Economics". Exploring Economics (in English).

- ↑ Zhukov, D.A. (2007). Biologija Povedenija. St. Petersburg, Russia: Rech.

- ↑ Selye, Hans (2013). [[[:模板:Google books]] Stress in Health and Disease]. Elsevier Science. 模板:Google books.

- ↑ Wilk, J. (1999), "Mind, nature and the emerging science of change: An introduction to metamorphology.", in G. Cornelis; S. Smets; J. Van Bendegem (eds.), EINSTEIN MEETS MAGRITTE: An Interdisciplinary Reflection on Science, Nature, Art, Human Action and Society: Metadebates on science, vol. 6, Springer Netherlands, pp. 71–87, doi:10.1007/978-94-017-2245-2_6

- ↑ O'Hanlon, B.; Wilk, J. (1987), Shifting contexts : The generation of effective psychotherapy., New York, N.Y.: Guilford Press.

- ↑ Dr. Jennifer Lunt and Malcolm Staves

- ↑ 41.0 41.1 Andrew Sparrow (2008-08-22). "Speak 'Nudge': The 10 key phrases from David Cameron's favorite book". The Guardian. London. Retrieved 2009-09-09.

- ↑ Campbell-Arvai, V; Arvai, J.; Kalof, L. (2014). "Motivating sustainable food choices: the role of nudges, value orientation, and information provision". Environment and Behavior. 46 (4): 453–475. doi:10.1177/0013916512469099.

- ↑ Kroese, F.; Marchiori, D.; de Ridder, D. (2016). "Nudging healthy food choices: a field experiment at the train station" (PDF). Journal of Public Health. 38 (2): e133–7. doi:10.1093/pubmed/fdv096. PMID 26186924.

- ↑ Carol Lewis (2009-07-22). "Why Barack Obama and David Cameron are keen to 'nudge' you". The Times. London. Retrieved 2009-09-09.

- ↑ James Forsyth (2009-07-16). "Nudge, nudge: meet the Cameroons' new guru". The Spectator. Archived from the original on 2009-01-24. Retrieved 2009-09-09.

- ↑ "Who we are". The Behavioural Insights Team.

- ↑ "First Obama, now Cameron embraces 'nudge theory'". The Independent. 12 August 2010.

- ↑ "Behavioural Insights". bi.dpc.nsw.gov.au. Department of Premier and Cabinet.

- ↑ Marsh, Tim (January 2012). "Cast No Shadow" (PDF). Rydermarsh.co.uk. Archived from the original (PDF) on 10 October 2017.

- ↑ Ebert, Philip; Freibichler, Wolfgang (2017). "Nudge management: applying behavioural science to increase knowledge worker productivity". Journal of Organization Design. 6:4. doi:10.1186/s41469-017-0014-1. hdl:1893/25187.

- ↑ Carrasco-Villanueva, Marco (2016). "中国的环境公共政策:一个行为经济学的选择 [Environmental Public Policies in China: An Opportunity for Behavioral Economics"]. In 上海社会科学院 [Shanghai Academy of Social Sciences] (in zh). 2016上海青年汉学家研修计划论文集. 中国社会科学出版社. pp. 368–392. ISBN 978-1-234-56789-7. https://archive.org/details/guidetolcshinfor00doej/page/368.

- ↑ Lakhani, Nina (December 7, 2008). "Unhealthy lifestyles here to stay, in spite of costly campaigns". The Independent. London. Retrieved April 28, 2010.

- ↑ Sunstein, Cass R. (2016-08-24) (in en). The Ethics of Influence: Government in the Age of Behavioral Science. Cambridge University Press.

- ↑ Yeung, Karen (2012-01-01). "Nudge as Fudge". The Modern Law Review (in English). 75 (1): 122–148. doi:10.1111/j.1468-2230.2012.00893.x. ISSN 1468-2230.

- ↑ Hausman, Daniel M.; Welch, Brynn (2010-03-01). "Debate: To Nudge or Not to Nudge*". Journal of Political Philosophy (in English). 18 (1): 123–136. doi:10.1111/j.1467-9760.2009.00351.x. ISSN 1467-9760.

- ↑ Lepenies, Robert; Małecka, Magdalena (2015-09-01). "The Institutional Consequences of Nudging – Nudges, Politics, and the Law". Review of Philosophy and Psychology (in English). 6 (3): 427–437. doi:10.1007/s13164-015-0243-6. ISSN 1878-5158.

- ↑ Alemanno, A.; Spina, A. (2014-04-01). "Nudging legally: On the checks and balances of behavioral regulation". International Journal of Constitutional Law (in English). 12 (2): 429–456. doi:10.1093/icon/mou033. ISSN 1474-2640.

- ↑ Kemmerer, Alexandra; Möllers, Christoph; Steinbeis, Maximilian; Wagner, Gerhard (2016-07-15). "Choice Architecture in Democracies: Exploring the Legitimacy of Nudging - Preface". Rochester, NY.

{{cite journal}}: Cite journal requires|journal=(help) - ↑ Sugden, Robert (2017-06-01). "Do people really want to be nudged towards healthy lifestyles?". International Review of Economics (in English). 64 (2): 113–123. doi:10.1007/s12232-016-0264-1.

- ↑ Cass R. Sunstein. "NUDGING AND CHOICE ARCHITECTURE: ETHICAL CONSIDERATIONS" (PDF). Law.harvard.edu. Retrieved 11 October 2017.

- ↑ "A nudge in the right direction? How we can harness behavioural economics". 1 December 2015.

- ↑ MÉREI, Ferenc (1987). "A perem-helyzet egyik változata: a szociálpszichológiai kontúr" [A variant of the edge-position: the contour social psychological]. Pszichológia (in Hungarian). 1: 1–5.

{{cite journal}}: CS1 maint: unrecognized language (link) - ↑ J. Scott Armstrong, Nicole Coviello and Barbara Safranek (1993). "Escalation Bias: Does It Extend to Marketing?" (PDF). Journal of the Academy of Marketing Science. 21 (3): 247–352. doi:10.1177/0092070393213008.

- ↑ "Dr. Donald A. Balenovich". Indiana University of Pennsylvania, Mathematics Department.

- ↑ "Ahmet Duran". Department of Mathematics, University of Michigan-Ann Arbor.

- ↑ "Dr Ray R. Sturm, CPA". College of Business Administration. Archived from the original on September 20, 2006.

- ↑ Tang, David (6 May 2013). "Why People Won't Buy Your Product Even Though It's Awesome". Flevy. Retrieved 31 May 2013.

- ↑ "Fama on Market Efficiency in a Volatile Market". Archived from the original on March 24, 2010.

- ↑ See Freeman, 2004 for a review

- ↑ Auman, Robert. "Game Theory".

- ↑ Camerer, Colin; Ho, Teck-Hua (March 1994). "Violations of the betweenness axiom and nonlinearity in probability". Journal of Risk and Uncertainty. 8 (2): 167–96. doi:10.1007/bf01065371.

{{cite journal}}: Invalid|ref=harv(help) - ↑ Andreoni, James; et al. "Altruism in experiments".

- ↑ Young, H. Peyton. "Social norms".

- ↑ Camerer, Colin (1997). "Progress in behavioral game theory". Journal of Economic Perspectives. 11 (4): 172. doi:10.1257/jep.11.4.167. Archived from the original on 2017-12-23. Retrieved 2014-10-31.

{{cite journal}}: Invalid|ref=harv(help) Pdf version. - ↑ Ho, Teck H. (2008). "Individual learning in games".

- ↑ Dufwenberg, Martin; Kirchsteiger, Georg (2004). "A Theory of Sequential reciprocity". Games and Economic Behavior. 47 (2): 268–98. CiteSeerX 10.1.1.124.9311. doi:10.1016/j.geb.2003.06.003.

- ↑ Gul, Faruk (2008). "Behavioural economics and game theory".

- ↑ {{cite web |first=Colin F. |last=Camerer |year=2008 |title=Behavioral game theory |url=http://www.dictionaryofeconomics.com/article?id=pde2008_B000302&q=Behavioral%20economics%20&topicid=&result_number=13

- ↑ Camerer, Colin (2003). [[[:模板:Google books]] Behavioral game theory: experiments in strategic interaction]. New York, New York Princeton, New Jersey: Russell Sage Foundation Princeton University Press. ISBN 978-0-691-09039-9. 模板:Google books.

- ↑ Loewenstein, George; Rabin, Matthew (2003). Advances in Behavioral Economics 1986–2003 papers. Princeton. http://press.princeton.edu/titles/8437.html.

- ↑ Fudenberg, Drew (2006). "Advancing Beyond Advances in Behavioral Economics". Journal of Economic Literature. 44 (3): 694–711. CiteSeerX 10.1.1.1010.3674. doi:10.1257/jel.44.3.694. JSTOR 30032349.

- ↑ Crawford, Vincent P. (1997). Kreps, David M; Wallis, Kenneth F. eds. Theory and Experiment in the Analysis of Strategic Interaction. Cambridge. pp. 206–42. doi:10.1017/CCOL521580110.007. ISBN 9781139052009. http://weber.ucsd.edu/~vcrawfor/CrawfordThExp97.pdf.

- ↑ Shubik, Martin (2002). "Chapter 62 Game theory and experimental gaming". Game Theory and Experimental Gaming. Handbook of Game Theory with Economic Applications. 3. Elsevier. pp. 2327–51. doi:10.1016/S1574-0005(02)03025-4. ISBN 9780444894281.

- ↑ Plott, Charles R.; Smith, Vernon l (2002). "45–66". Game Theory and Experimental Gaming. Handbook of Experimental Economics Results. 4. Elsevier. pp. 387–615. doi:10.1016/S1574-0722(07)00121-7. ISBN 9780444826428.

- ↑ Games and Economic Behavior (journal), Elsevier. Online

- ↑ Ferster, C. B. (1957). Schedules of Reinforcement. New York: Appleton-Century-Crofts. https://archive.org/details/schedulesofreinf0000fers.

- ↑ Chen, M. K.; et al. (2006). "How Basic Are Behavioral Biases? Evidence from Capuchin Monkey Trading Behavior". Journal of Political Economy. 114 (3): 517–37. CiteSeerX 10.1.1.594.4936. doi:10.1086/503550.

- ↑ 88.0 88.1 88.2 Battalio, R. C.; et al. (1981). "Income-Leisure Tradeoffs of Animal Workers". American Economic Review. 71 (4): 621–32. JSTOR 1806185.

- ↑ Kagel, John H.; Battalio, Raymond C.; Green, Leonard (1995). [[[:模板:Google books]] Economic Choice Theory: An Experimental Analysis of Animal Behavior]. Cambridge University Press. ISBN 978-0-521-45488-9. 模板:Google books.

- ↑ Kagel, J. H.; et al. (1981). "Demand Curves for Animal Consumers". Quarterly Journal of Economics. 96 (1): 1–16. doi:10.2307/2936137. JSTOR 2936137.

- ↑ Paul H. Rubin and C. Monica Capra. The evolutionary psychology of economics. In Roberts, S. C. (2011). Roberts, S. Craig. ed. Applied Evolutionary Psychology. Oxford University Press. doi:10.1093/acprof:oso/9780199586073.001.0001.

- ↑ 92.0 92.1 Marwala, Tshilidzi; Hurwitz, Evan (2017). Artificial Intelligence and Economic Theory: Skynet in the Market. London: Springer.

- ↑ Roth, Alvin E. (2002). "The Economist as Engineer: Game Theory, Experimentation, and Computation as Tools for Design Economics" (PDF). Econometrica. 70 (4): 1341–1378. doi:10.1111/1468-0262.00335.

- ↑ See; Grechenig, K.; Nicklisch, A.; Thöni, C. (2010). "Punishment despite reasonable doubt—a public goods experiment with sanctions under uncertainty". Journal of Empirical Legal Studies. 7 (4): 847–867.

- ↑ J. DiNardo, 2008. "natural experiments and quasi-natural experiments," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

- ↑ 96.0 96.1 "Research". Duke Institute for Brain Sciences.

- ↑ Levallois, Clement; Clithero, John A.; Wouters, Paul; Smidts, Ale; Huettel, Scott A. (2012). "Translating upwards: linking the neural and social sciences via neuroeconomics". Nature Reviews Neuroscience. 13 (11): 789–797. doi:10.1038/nrn3354. ISSN 1471-003X. PMID 23034481.

- ↑ Loewenstein, G.; Rick, S.; Cohen, J. (2008). "Neuroeconomics". Annual Reviews. 59: 647–672. doi:10.1146/annurev.psych.59.103006.093710.

参考文献

- Ainslie, G. (1975). "Specious Reward: A Behavioral /Theory of Impulsiveness and Impulse Control". Psychological Bulletin. 82 (4): 463–96. doi:10.1037/h0076860. PMID 1099599.

- Barberis, N.; Shleifer, A.; Vishny, R. (1998). "A Model of Investor Sentiment". Journal of Financial Economics. 49 (3): 307–43. doi:10.1016/S0304-405X(98)00027-0. Archived from the original on 20 April 2008. Retrieved 2008-04-25.

- Becker, Gary S. (1968). "Crime and Punishment: An Economic Approach" (PDF). The Journal of Political Economy. 76 (2): 169–217. doi:10.1086/259394.

- Benartzi, Shlomo; Thaler, Richard H. (1995). "Myopic Loss Aversion and the Equity Premium Puzzle" (PDF). The Quarterly Journal of Economics. 110 (1): 73–92. doi:10.2307/2118511. JSTOR 2118511.

{{cite journal}}: Invalid|ref=harv(help)

- Cunningham, Lawrence A. (2002). "Behavioral Finance and Investor Governance". Washington & Lee Law Review. 59: 767. doi:10.2139/ssrn.255778. ISSN 1942-6658.

- Daniel, K.; Hirshleifer, D.; Subrahmanyam, A. (1998). "Investor Psychology and Security Market Under- and Overreactions" (PDF). Journal of Finance. 53 (6): 1839–85. doi:10.1111/0022-1082.00077. hdl:2027.42/73431.

- Diamond, Peter; Vartiainen, Hannu (2012). [[[:模板:Google books]] Behavioral Economics and Its Applications]. Princeton University Press. 模板:Google books.

- The New Palgrave: A Dictionary of Economics. Macmillan. 1988. ISBN 978-0-935859-10-2.

- Augier, Mie. Simon, Herbert A. (1916–2001).

- Bernheim, B. Douglas; Rangel, Antonio. Behavioral public economics.

- Bloomfield, Robert. Behavioral finance.

- Simon, Herbert A. Rationality, bounded.

- Genesove, David; Mayer, Christopher (March 2001). "Loss Aversion and Seller Behavior: Evidence from the Housing Market" (PDF). Quarterly Journal of Economics. 116 (4): 1233–1260. doi:10.1162/003355301753265561.

- Mullainathan, S.; Thaler, R. H. (2001). "Behavioral Economics". International Encyclopedia of the Social & Behavioral Sciences. pp. 1094–1100. doi:10.1016/B0-08-043076-7/02247-6.

- Garai, Laszlo (2016-12-01). "Identity Economics: "An Alternative Economic Psychology"" (in en). Reconsidering Identity Economics. New York: Palgrave Macmillan US. pp. 35–40. doi:10.1057/978-1-137-52561-1_3. ISBN 9781137525604.

- McGaughey, E. (2014). "Behavioural Economics and Labour Law". SSRN 2435111. Retrieved 2018-06-02.

- Hens, Thorsten; Bachmann, Kremena (2008). Behavioural Finance for Private Banking. Wiley Finance Series. ISBN 978-0-470-77999-6. http://www.bfpb.ch.

- Hogarth, R. M.; Reder, M. W. (1987). Rational Choice: The Contrast between Economics and Psychology. Chicago: University of Chicago Press. ISBN 978-0-226-34857-5. https://archive.org/details/rationalchoice.

- Kahneman, Daniel; Tversky, Amos (1979). "Prospect Theory: An Analysis of Decision under Risk". Econometrica. 47 (2): 263–91. CiteSeerX 10.1.1.407.1910. doi:10.2307/1914185. JSTOR 1914185.

- Kahneman, Daniel; Diener, Ed (2003). Well-being: the foundations of hedonic psychology. Russell Sage Foundation.

- Kirkpatrick, Charles D.; Dahlquist, Julie R. (2007). Technical Analysis: The Complete Resource for Financial Market Technicians. Upper Saddle River, NJ: Financial Times Press.

- Kuran, Timur (1997). Private Truths, Public Lies: The Social Consequences of Preference Falsification. Harvard University Press. pp. 7–. Description

- Luce, R Duncan (2000). Utility of Gains and Losses: Measurement-theoretical and Experimental Approaches. Mahwah, New Jersey: Lawrence Erlbaum Publishers.

- Plott, Charles R.; Smith, Vernon L. (2008). Handbook of Experimental Economics Results. 1. Elsevier. Chapter-preview links.

- Rabin, Matthew (1998). "Psychology and Economics" (PDF). Journal of Economic Literature. 36 (1): 11–46. Archived from the original (PDF) on September 27, 2011.

{{cite journal}}: Invalid|ref=harv(help)

- Shefrin, Hersh (2002). "Behavioral decision making, forecasting, game theory, and role-play" (PDF). International Journal of Forecasting. 18 (3): 375–382. doi:10.1016/S0169-2070(02)00021-3.

{{cite journal}}: Invalid|ref=harv(help)

- Schelling, Thomas C. (2006). Micromotives and Macrobehavior. W. W. Norton. Description

- Shleifer, Andrei (1999). Inefficient Markets: An Introduction to Behavioral Finance. New York: Oxford University Press. ISBN 978-0-19-829228-9. https://archive.org/details/inefficientmarke00andr.

- Simon, Herbert A. (1987). "Behavioral Economics". The New Palgrave: A Dictionary of Economics. Vol. 1. pp. 221–24.

- Thaler, Richard H (2016). "Behavioral Economics: Past, Present, and Future". American Economic Review. 106 (7): 1577–1600. doi:10.1257/aer.106.7.1577.

- Thaler, Richard H.; Mullainathan, Sendhil (2008). "Behavioral Economics". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty.

- Wheeler, Gregory (2018). "Bounded Rationality". In Edward Zalta (ed.). Stanford Encyclopedia of Philosophy. Stanford, CA.

- "Behavioral economics in U.S. (antitrust) scholarly papers". Le Concurrentialiste.

外部链接

- The Behavioral Economics Guide

- Overview of Behavioral Finance

- The Institute of Behavioral Finance

- Stirling Behavioural Science Blog, of the Stirling Behavioural Science Centre at University of Stirling

- Society for the Advancement of Behavioural Economics

- Behavioral Economics: Past, Present, Future – Colin F. Camerer and George Loewenstein

- A History of Behavioural Finance / Economics in Published Research: 1944–1988

- MSc Behavioural Economics, MSc in Behavioural Economics at the University of Essex

- Behavioral Economics of Shipping Business

编者推荐

集智课程

行为经济学与实验经济学 | 复杂经济学读书会第十八期(三)

经济是一个具有无比庞大的并发行为的复杂系统。市场、价格、产业、交易合约和制度,全都形成于这些并发行为中,并最终形成了经济的总体表现或聚合模式。

复杂经济学是看待这种复杂经济系统的一种完全不同的方式。复杂经济学这个概念由布莱恩·阿瑟(W. Brain Arthur)于 1999 年在《Science》上发表的一篇论文中提出。阿瑟也被视为复杂经济学的创始人。

该课程是对复杂经济学读书会总结。

系统科学与社会经济

- 为什么一家企业的崩盘可以引起金融体系的崩溃?

- 为什么击毙恐怖分子头目却无法消除恐怖主义威胁?

- 为什么城市道路越来越多而交通状况却日益严峻?

- 为什么调整公共交通站点就可以大幅减少交通拥堵?

金融、安全、交通、经济等诸多问题之所以相互交织、难以解决,是因为它们依托于社会经济这个复杂系统。只有理解系统,才能应对复杂性的挑战。

为了普及系统思维,传播系统科学,集智学园特邀北京师范大学系统科学学院李红刚教授,制作”系统科学与社会经济“系列课程,帮助大家建立基于”整体”和“演化“的系统思维,并借助系统思维和系统方法来认识社会经济系统。

随着社会经济快速发展,如何理解并影响社会经济系统,成为各个行业亟需的知识:

如何挖掘出可以撬动大系统的”小行动“? 如何根据要素之间关系预测系统未来趋势? 如何判断产业、城市、市场的动态变化? 如何为组织制定简单而且高效的行动规则? 该课程是复杂系统的相关研究,将为你提供回答这些问题的崭新视角。

集智斑图

复杂经济学读书会论文清单

在经济学的研究历史中,强调非均衡性和复杂性的思想,已经有很长的历史,熊彼特、凡勃伦、哈耶克、沙克尔等经济学家都有贡献。现在我们有了更系统的复杂性理论,更丰富的实证研究基础,更强大的计算和模拟工具,以及更迫切的现实需求,因而可以说复杂经济学的研究有幸赶上了新的历史机遇,召唤我们有志青年学者学生在新的平台上推进复杂经济学的传播和研究。

从更高的层面看,复杂性思维其实是席卷了所有学科的一场运动,而不仅仅是一个研究课题。集智俱乐部长期关注复杂性科学研究进展,其思想和方法可以为经济学研究再开一扇通向未来之门。

本中文词条由嘉树编译,已由和光同尘审校审校,薄荷编辑,如有问题,欢迎在讨论页面留言。

本词条内容源自wikipedia及公开资料,遵守 CC3.0协议。

- CS1 español-language sources (es)

- CS1 maint: unrecognized language

- CS1 errors: missing periodical

- CS1 English-language sources (en)

- CS1 errors: invalid parameter value

- All articles with unsourced statements

- Articles with unsourced statements from July 2016

- Articles with invalid date parameter in template

- 行为经济学

- 行为金融学

- 金融经济学

- 市场趋势

- 微观经济学

- 展望理论